• Prices Unable to Hold Gains This Week

• Continuing Jobless Claims Decreased by 1.24 Million

• China is Week’s Top Buyer of U.S. Cotton

• More Rain Forecasted, but Uncertain

Futures attempted successive rallies on Monday and Tuesday, coming within one point of last week’s high of 66.45 cents per pound, but prices were not able to hold onto their gains for the week. Cotton futures fell with the rest of the commodity sector on Wednesday as a rally in the U.S. Dollar pressured prices. A sharp “risk off” day in broader financial markets pushed prices lower again on Thursday. December futures finished the week at 64.28 cents, down 109 points for the week. Despite only moderate trading volumes, open interest surged again. Traders opened another 6,168 contracts to finish the week at 210,049 open interest, which is another new high since March.

OUTSIDE MARKETS

After making more fresh highs a few days this week, stocks had their worst decline in a few months on Thursday. The S&P 500 gave back the past seven sessions’ gains, and the NASDAQ fell over 5%. The Dow Jones Industrial Average did not fall quite as hard, but it had not risen as far as the others either. Despite the sharp decline, stocks are still near their recent record highs. The sell off seemed to be profit taking ahead of Friday’s Non-Farm Payroll figures.

Other job numbers were relatively positive. New jobless claims fell back below one million to 881,000, which beat analysts’ expectations. Although the number of people still losing jobs is very large, the number of continuing claims decreased by 1.24 to 13.25 million people. Insured unemployment is down 47% from its peak on May 9 of nearly 25 million, but there is a long way to go to backfill the holes caused by these hard times.

EXPORT SALES

Exports sales continue to limp along with a relatively low pace at 131,500 bales of net new sales, but commitments are still relatively high. China was this week’s best buyer once again, purchasing 61,400 bales. The next largest buyers were Vietnam (30,200 bales) and Turkey (17,000). 286,000 bales of Upland and Pima combined shipped last week as delayed shipments and China’s spring purchases have kept the pipeline full. Accumulated exports have reached 1.29 million bales, which is the highest level ever at the fourth week of the marketing year. While the sales to China on today’s report were an encouragement to traders, demand will have to broaden to many more countries for the market to feel comfortable about this year’s prospects.

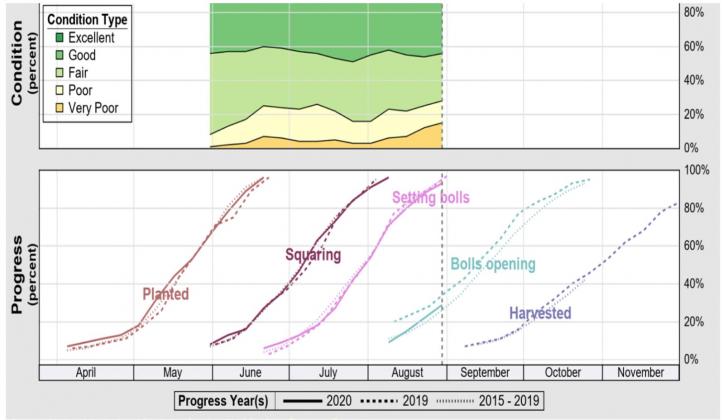

CROP CONDITIONS AND WEATHER

Hurricane Laura soaked the western half of the Mid-South last week, causing significant crop condition declines in both Louisiana and Arkansas. Some of West Texas and most of Southwest Oklahoma had a nice break from recent dryness as several decent showers swept through. Rainfall was a bit more mixed farther to the west side of the High Plains. The next week continues to bring hopes of rain for Texas and Oklahoma, but the weather forecasts are notably uncertain. While there is little dryland cotton left on the High Plains to benefit from potential precipitation, irrigated yields could benefit. Cooler temperatures are in the forecast, with mid-September highs expected to be below normal.

THE WEEK AHEAD

Traders are keeping one eye on the Atlantic still, watching for any further tropical storms. The action in the outside markets is still clearly a concern as well. Recent speculative buyers may find it difficult to keep buying cotton if risk sentiment sours. Of course, the weekly Export Sales Report will take its share of attention, too. Most traders’ minds have already begun to wander towards the September Crop Production and WASDE reports that will be released next Friday at 11 a.m. Central Time.