• Export Sales Lower Than Previous Week

• Hurricane Delta to Impact Cotton Belt

• October Crop Production Report and WASDE Released Friday

• Report Lowered U.S. Production 19,000 Bales

December futures faltered to 64.86 cents per pound last Friday but rallied to a fresh seven-month high when Monday came. Hurricane Delta kept the market moving upward from there. After touching the week’s high at 68.29 cents on Thursday, December prices gave back a little of their gains to settle at 67.49 cents, up 158 points for the week. Upward momentum and new highs attracted new players to the market. Daily trading volumes surged and open interest increased 4,100 contracts to 226,996.

OUTSIDE MARKETS

Stock markets were whipsawed by an abrupt announcement that federal Covid-19 support negotiations were unsuccessful and over. Markets fell from gains to sharp losses on Tuesday. Thankfully, public stances seemed to soften Wednesday and the markets resumed moving higher. Better economic data and forecasts helped to cheer investors, but the outlook still remained gloomy enough that Federal Reserve governors continued public calls for more fiscal stimulus.

Other commodities also had a great week. Crude oil made gains and corn is at its highest in nearly a year. Soybeans have made an impressive 31-month high on a combination of poor weather, strong export sales, and speculative buying.

EXPORT SALES

This week’s export sales were lower than last week, but still better than needed for the USDA’s current export target. Exporters sold another 178,400 bales of Upland cotton and 21,700 bales of Pima. The largest Upland buyers were Vietnam with 125,500 bales, China with 26,700, and Pakistan with 21,500.

Demand was notably less distributed than last week, and small cancellations were visible across several markets. Combined shipments slowed sharply to 158,100 bales, but accumulated shipments for the season are still nearly 600,000 bales ahead of last year’s pace and one million bales ahead of 2018/19.

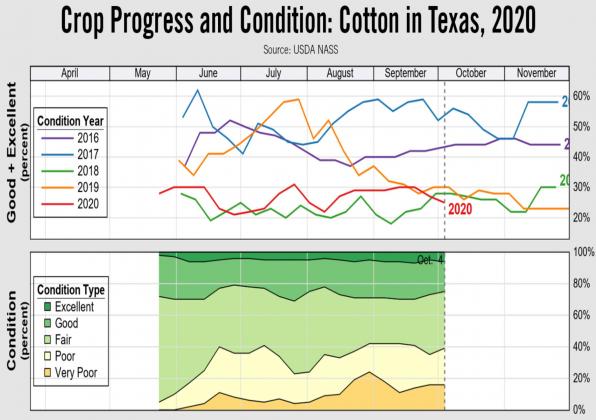

CROP CONDITIONS AND WEATHER

Yet another tropical storm is impacting the Cotton Belt as Hurricane Delta is forecast to make landfall on the Gulf Coast. Unfortunately, this week’s crop progress report shows that 93% of Mid-South cotton was open on last Sunday and only 14% was harvested.

Louisiana was 99% open and 39% harvested, and Mississippi was 92% open and 17% harvested. At a minimum, the storm will bring a large quantity of unwelcome weather to the Mid-South and parts of the Southeast.

WASDE

The USDA released its October Crop Production Report and World Agricultural Supply and Demand Estimates (WASDE) on Friday.

Traders were shocked that the USDA lowered U.S. production just 19,000 bales since last month’s estimate to 17.045 million bales. Southeastern production did not seem to reflect much hurricane damage from Sally as the average yield for that region increased 7 pounds. Average yield for the Mid-South fell 16 pounds, but overall production for the Memphis eastern territory was just 25,000 bales lower at 8.8 million bales. Southwest yields were also mixed.

Oklahoma’s production estimate fell 170,000 bales with yield falling 177 pounds to 762. On the other hand, the USDA surprised analysts by increasing Texas’ average yield 25 pounds to 761. The Texas production estimate moved up 200,000 bales to 6.1 million Upland bales.

On the back of a relatively unchanged U.S. crop forecast, the rest of the U.S. balance sheet went unchanged. World estimates were more interesting. Global production was lowered 934,000 bales to 116.27 mostly on big decreases for Pakistan, Mali, and Greece. Conversely, the USDA increased world consumption by 1.52 million bales to 114.21 as both China and India have shown more resilient consumption than expected.

China’s imports were also raised 500,000 bales to 9.5 million, while Brazil’s exports were also lifted 500,000 to 9.7 million. The net impact of the changes reduced expected world ending stocks 2.71 million bales to 101.13 million. Overall the reports showed a looser U.S. balance sheet than expected, but included welcome surprises on the world balance sheet.