• Next U.S. President Still Unknown

• Marketing Year First Quarter Exports at Highest Level Ever

• WASDE and Crop Production Report Release Tuesday

December futures started the week by continuing last week’s decline. Prices fell as low as 68.06 cents per pound, the week’s low, on Monday where they seemed to find support. Tuesday saw prices rally sharply while Wednesday and Thursday were able to make slightly higher highs in intra-day trading. December finished the week at 70.07 cents, up 25 points for the week. March futures did slightly better, gaining 41 points for the week to close at 71.21. Daily trading volumes remain elevated as traders continue to ramp up the pace of rolling positions from the December contract into March. Open interest shows that the selloff also included traders closing positions as the number of open contracts declined 6,236 to 234,215, which was the first significant weekly decline since August.

OUTSIDE MARKETS

As of this writing, we still don’t know who the next President of the United States will be. What we do know is that the expected “Blue Wave” that had been predicted by many polls failed to materialize. Republicans seem to have held onto the Senate and gained some seats in the House, which has political forecasters predicting slim chances that President Trump’s tax overhaul will be undone. There are also lower odds that a larger version of additional stimulus will pass, which leaves the Federal Reserve with more work to do. The major stock indices have more than recuperated last week’s decline while the U.S. dollar is back to recent lows versus other major currencies.

EXPORT SALES

The impending election and the recent run-up in prices seem to have dampened mill demand somewhat last week according to the Export Sales Report. Gross export sales of Upland cotton were 232,600 bales last week, but shippers also cancelled orders for 117,100 bales, so net new sales were 115,600. While the level is a bit disappointing, it is actually fairly close to the median for the 13th week of the marketing year.

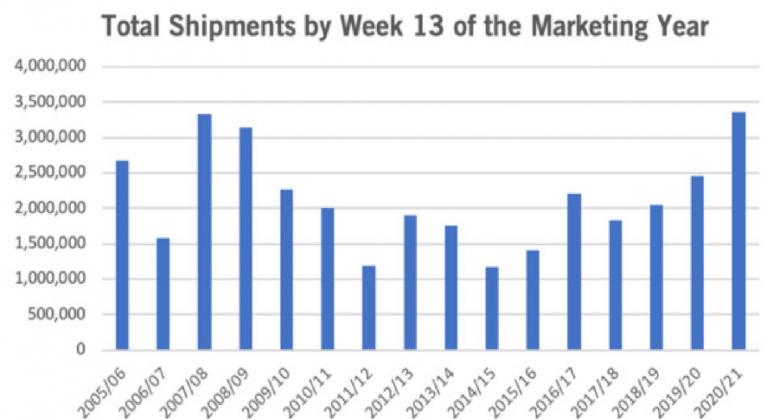

Pima sales were healthy at 16,800 bales. Shipments of both Upland and Pima continue to outperform recent years. Last week, combined shipments were 291,900 bales, which is nearly double last year’s figure for the same week. In fact, at 3,358,960 bales of reported shipments, accumulated exports for the first quarter of the marketing year are at their highest level ever.

WASDE AND CROP PRODUCTION NEXT WEEK

On Tuesday morning at 11 a.m. central, the USDA will release the November World Agricultural Supply and Demand Estimates (WASDE) and the Crop Production Report. Weather has absolutely battered the crop over the past month. Ice storms and hurricanes have pushed crop conditions lower and put the majority of states well behind their average harvest pace. There are widespread expectations that the U.S. crop will be smaller than the USDA’s October forecast (17.05 million bales). Decreases are expected in every region but the far west, as producers have generally reported disappointing yields. World crop production may also fall as adverse weather has affected crops in other countries as well. The demand picture is more difficult to assess, but expected supply reductions have analysts looking for a slightly tighter balance sheet on Tuesday’s report.

THE WEEK AHEAD

Although the election is not completely over, the results so far have removed a lot of uncertainty from the market. The extra attention traders have is likely to be dedicated entirely to next week’s WASDE report. Right or wrong, the USDA’s balance is the gold standard for supply and demand analysis, and a large number of traders form their market opinion on its numbers. Beyond Tuesday’s WASDE, traders will be watching next week’s export sales report to see whether mill demand for U.S. returned as prices declined